Epistar's Q3 faces challenges with full capacity of blue LED/quaternary LED production

Published Time:

2021-08-04

Although new production capacity from mainland Chinese manufacturers remains to be released, its impact on prices may be deferred until the first half of next year. In the third quarter, Epistar's CSP shipments increased, boosted by a large order for plant lighting and the explosive growth of small-pitch display applications, supporting the utilization rate of its four-element LEDs. This quarter, Epistar aims to achieve full capacity utilization for both blue LEDs and four-element LEDs.

Although new production capacity from Chinese manufacturers is still to be released, the impact on prices may be delayed until the first half of next year. Thanks to increased CSP shipments, large orders for plant lighting, and the booming application of small-pitch displays supporting the utilization rate of four-element LEDs, Epistar is challenging the full capacity of both blue and four-element LEDs in Q3.

At the beginning of the year, during the optoelectronics exhibition, Epistar's general manager, Zhou Mingjun, predicted that new production capacity from Chinese manufacturers such as San'an Optoelectronics, HC Semitek, and Aoyang Shun Chang would continue to be put into operation. Epistar estimated that the production capacity would be released in August this year, therefore holding a reserved attitude towards blue LED prices after Q3. However, as Chinese manufacturers adopt domestically produced MOCVD equipment, there seems to be a longer learning curve, and the production capacity release is not very smooth. A new wave of blue LED capacity release may be delayed until Q4 to the first half of next year.

Epistar pointed out that in order to obtain government subsidies, Chinese manufacturers have begun to use domestically produced MOCVD equipment, impacting international equipment manufacturers such as Veeco. Their operations are currently under pressure. Due to the learning curve required by Chinese manufacturers, Epistar judges that if the learning curve is fast enough, production capacity may be released after Q4. The fourth quarter of the year and the first quarter of the following year are relatively slow seasons for the LED industry, so there may be pressure on blue LED prices in the first half of next year.

However, in the short term, Epistar's operations have improved, and the quality and quantity of orders for blue and four-element LEDs have significantly improved in Q3.

Regarding blue LEDs, Epistar pointed out that the demand for TV backlights is relatively weak this year. However, Korean manufacturers are introducing CSP (chip-scale packaging) chips into high-end TV models, and Q3 is the traditional peak season for televisions. Epistar's CSP shipments are expected to reach their peak, with estimated monthly shipments increasing from nearly 20 million units in the same period last year to 40-50 million units. These products are resistant to price drops, which helps maintain Epistar's blue LED gross profit margin.

As for four-element LEDs, Epistar stated that ultra-high-brightness four-element LEDs are currently operating at full capacity due to the high-end applications of small-pitch displays. However, high-brightness four-element LEDs cannot maintain full capacity due to the weakening demand in the mid-range market. In addition, Epistar has received orders from Philips in the plant lighting field. This project purchases Epistar's 660-nanometer red chips, paired with Philips' self-produced blue chips. Shipments will peak in Q3, and this order will help maintain the full capacity of the four-element LED production line.

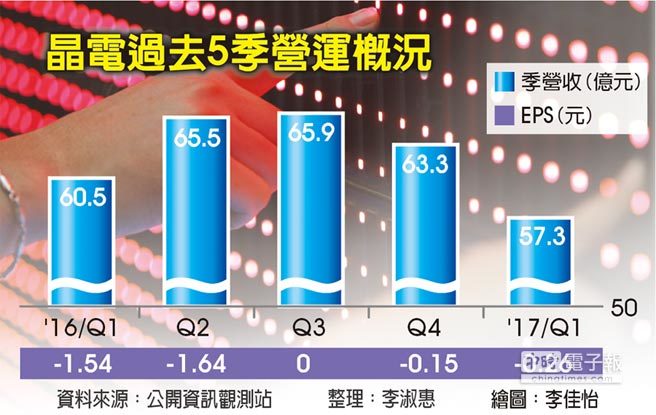

Currently, Epistar's blue LEDs are 60% for lighting and 30% for backlights, with blue LEDs accounting for 70% of its operations, and four-element LEDs accounting for 30%. Given the situation of unhindered orders in Q3, analysts expect Epistar's Q3 operations to achieve double-digit growth.