SMT Industry In-Depth Analysis: How Surface Mount Technology Shapes the Future of Electronics Manufacturing

Published Time:

2025-10-21

From smartphones to electric vehicles, sophisticated electronic components are being accurately placed on circuit boards at an astonishing rate, all of which is inseparable from the support of surface mount technology.

In the electronics manufacturing industry, surface mount technology (SMT), a core component of electronic assembly, has a direct impact on the overall progress of the electronics industry. With the rapid rise of emerging sectors such as 5G communications, the Internet of Things (IoT), automotive electronics, and wearable devices, the requirements for SMT precision, speed, and performance are continuously increasing.

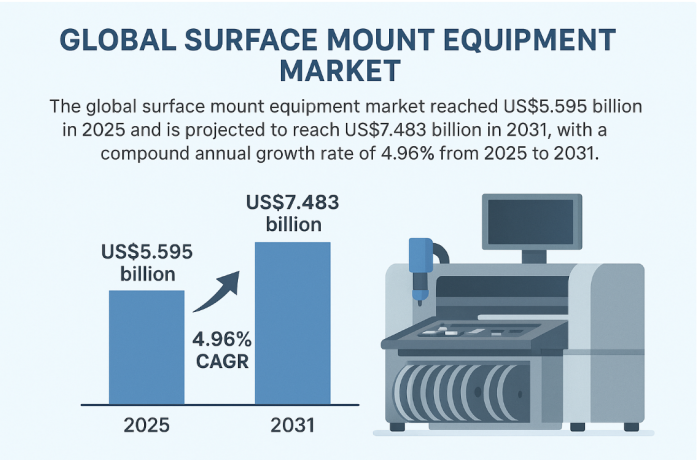

According to QYResearch, the global surface mount equipment market reached US$5.595 billion in 2025 and is projected to reach US$7.483 billion in 2031, with a compound annual growth rate of 4.96% from 2025 to 2031. This growth is primarily driven by the increasing demand for automation across various industries to improve operational efficiency and address labor shortages.

01 Industry Status: The SMT Market Continues to Grow, with China Emerging as a Global Manufacturing Hub

Surface mount technology (SMT) is an electronic circuit assembly method that mounts components directly onto the surface of a printed circuit board (PCB). Unlike traditional through-hole technology, SMT enables smaller, lighter, and more compact designs, resulting in higher circuit density and faster automated assembly.

SMT components can be placed on both sides of a PCB, improving design flexibility and cost-effectiveness. This technology is widely used in consumer electronics, automotive electronics, industrial machinery, telecommunications, aerospace, and medical equipment, and is a core driver of modern electronics manufacturing.

According to a QYResearch report, the global SMT market revenue reached 40.256 billion RMB in 2024 and is projected to reach 58.498 billion RMB by 2030, with a compound annual growth rate of 6.43%.

The Chinese market has undergone rapid growth in the past few years, reaching 11.368 billion RMB in 2024, accounting for approximately % of the global market. China has become the world's undisputed electronics manufacturing center, and SMT is the core of electronics manufacturing.

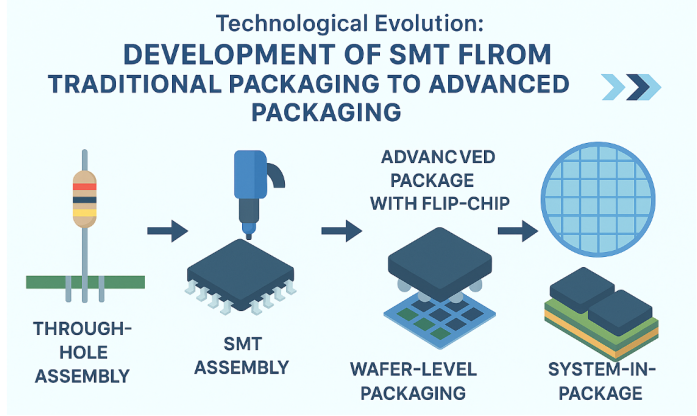

02 Technological Evolution: The Development of SMT from Traditional Packaging to Advanced Packaging

Electronic packaging technology has undergone a revolutionary transformation from traditional through-hole assembly to surface mount technology. Through-hole assembly once dominated the electronics manufacturing sector, but with the increasing demand for miniaturization and higher performance in electronic devices, its limitations have gradually become apparent.

The widespread adoption of surface mount technology is a major revolution in electronic packaging. It eliminates the cumbersome through-hole assembly process and directly mounts electronic components on the surface of the PCB, connecting the components to the PCB through processes such as reflow soldering.

SMT packaging offers many significant advantages: it significantly increases the assembly density of electronic devices, allowing them to be significantly reduced in size; secondly, SMT packaging boasts high production efficiency, with automated production equipment enabling rapid and precise component placement, reducing production costs.

As electronic technology evolves towards higher performance, smaller size, and lower power consumption, advanced packaging technologies have emerged. These technologies include flip-chip, wafer-level packaging, and system-in-package.

Flip chip packaging is to turn the chip upside down and connect it directly to the PCB or substrate through connection structures such as solder balls. This method can achieve short-distance interconnection between the chip and the packaging substrate.

03 Market Landscape: Global Competition and the Rise of Chinese Companies

The SMT equipment market presents a global competitive landscape, dominated by a group of internationally renowned companies. Global leaders include ASMPT, Fujifilm, Panasonic, Yamaha Robotics, JUKI, and Mycronic. These companies have advantages in technological accumulation and market share.

The Asia-Pacific region, particularly China, with its vast electronics manufacturing base, is the world's largest SMT market. Meanwhile, Europe and North America maintain strong growth in high-reliability applications such as aerospace and medical equipment.

China's electronics manufacturing industry has been introducing SMT production lines for over 30 years since the 1980s. Application levels have continuously improved, and significant achievements have been made in SMT equipment research and development.

SMT equipment such as printing machines, welding, and testing has largely achieved domestic production, and with competitive pricing, it holds a 70%-80% domestic market share.

With the dual benefits of intelligent manufacturing and domestic substitution, demand for SMT placement machines in China is expected to reach 64,312 units in 2025. Policies such as China's "Smart Manufacturing 2025" initiative are driving technological breakthroughs and increasing market share for local SMT manufacturers. Intelligent, flexible, and green technologies will become the core drivers of industry development.

04 Industrial Chain Ecosystem: Collaborative Development of Upstream and Downstream Industries

The SMT industry relies on a comprehensive industrial chain. From key components to system integration, collaborative innovation at every stage drives progress across the industry.

The upstream industry primarily includes solder paste, adhesives, flux, sensors, precision motors, cameras, nozzles, and automation systems. Major suppliers include Henkel (adhesives), Indium Corporation (solder paste), Asahi Kasei (chemicals), Omron and Keyence (sensors/automation), and Murata Manufacturing (components).

Midstream equipment manufacturers such as ASMPT, Panasonic, Fuji, Yamaha Robotics, JUKI, and Mycronic integrate these technologies into SMT machines.

Downstream applications include electronics manufacturing service providers such as Foxconn, Flextronics, Jabil, Tianhong, and Pegatron, as well as original equipment manufacturers (OEMs) such as Apple, Samsung, Intel, Bosch, and Siemens.

These companies apply SMT to consumer electronics, telecommunications systems, electric vehicle electronics, aerospace, and medical devices.

05 Technology Trends: Intelligence, High Precision, and Environmental Protection

The SMT equipment industry stands at the crossroads of maturity and breakthrough. While playing a cornerstone role in large-scale production in the electronics industry, it also faces real challenges such as precision bottlenecks, labor reliance, and system fragmentation.

SMT production lines in future factories will exhibit the following development trends:

Intelligence and Industry 4.0: The integration of artificial intelligence, machine vision, and the Industrial Internet of Things into SMT production lines is a core trend. This enables predictive maintenance, real-time monitoring, and automated quality inspection, significantly improving efficiency and reducing production defects.

Equipment implements closed-loop inspection and possesses deep learning capabilities, enabling self-optimization through error handling. All equipment platforms are compatible and integrated with enterprise MES systems, allowing a single server to simultaneously control multiple production lines.

High Precision and High Performance: SMT equipment is developing towards high precision, high speed, ease of use, greater environmental protection, and greater flexibility. For example, placement heads can automatically switch between different functions, and placement heads can perform dispensing, printing, and inspection feedback, resulting in more stable placement accuracy.

Green Manufacturing: SMT production lines are moving towards a "green" and environmentally friendly approach. From electronic component packaging materials, glue, flux, and other SMT process materials to the production process, all contribute to environmental pollution. The more SMT lines there are and the larger their scale, the more severe this pollution becomes.

Therefore, new SMT production lines are moving towards a green approach.

06 Application Areas: Diversified Demand Drives Growth

SMT technology and its applications have penetrated numerous industries, from traditional consumer electronics to high-end semiconductor packaging. These diverse sectors present diverse demands for SMT equipment.

Consumer electronics is the most traditional and primary application area for SMT technology. Demand for SMDs continues to grow in smartphones, laptops, and smart home devices. Modern smartphones are able to integrate numerous complex functional modules within a compact body, largely due to the application of SMT technology.

Automotive electronics, particularly driven by electric vehicles and advanced driver assistance systems, is becoming a key growth area for the SMT market due to its demand for compact, high-reliability electronic components. The increasing demand for high-reliability and high-temperature-resistant SMDs in the automotive electronics market is driving the development of customized and high-performance products.

Network Communications/Servers: The surge in demand for high-end PCBs for AI servers and high-speed network equipment is currently one of the fastest-growing drivers. The high-frequency and high-speed characteristics of 5G technology place even higher demands on electronic packaging.

Aerospace and Medical Devices: Electronic products in these sectors demand extremely high reliability, requiring SMT technology to provide high-reliability solutions. Demand for high-precision and multifunctional SMDs is also increasing in fields such as industrial automation and medical electronics.

07 Challenges and Opportunities: Key Issues Facing the Industry

The SMT industry, while rapidly developing, also faces numerous challenges and opportunities.

Technical Challenges

Although SMT technology has matured, it still faces the following challenges: equipment accuracy has not yet reached 100%, and operational errors can still lead to scrapped PCB soldering; manual equipment intervention, inspection, and repair are required; complex and precise components are subject to aging and damage, potentially causing production line downtime; and data platforms between equipment from different manufacturers face compatibility issues.

Market Opportunities

The continuous emergence of emerging application areas has created tremendous market opportunities for the SMT industry. The rapid development of new energy vehicles, 5G communications, artificial intelligence, the Internet of Things, and other fields has created new demands for SMT technology.

The development opportunities in the surface mount device market primarily stem from the continuous innovation and intelligentization of electronic products. With the rapid development of emerging fields such as 5G communications, the Internet of Things, automotive electronics, and wearable devices, the demand for high-performance and miniaturized electronic components has increased significantly, driving the widespread application of SMD technology.

08 Future Outlook: The Development Direction of SMT Technology

Faced with the ongoing transformation of the electronics manufacturing industry, SMT technology will develop towards greater intelligence, flexibility, and precision.

Intelligent Upgrade: The integration of artificial intelligence, big data, and industrial Internet technologies will bring SMT a deeper level of intelligent upgrade. Future SMT equipment will possess more powerful self-learning, adaptive, and self-optimization capabilities. Through data analysis and machine learning algorithms, it will continuously optimize placement parameters and paths, further improving placement quality and efficiency.

Continuous Improvement in Precision: As surface mount electronic components continue to shrink in size and become increasingly complex in function, the requirements for placement precision will continue to increase. The evolution from the current micron level to the submicron and even nanometer level is an inevitable trend in SMT technology.

Flexible Development: To accommodate high-mix, small-batch production models, SMT equipment is becoming increasingly flexible. Modular design allows various functional units to be combined according to specific production processes to achieve optimal production results.

Green Manufacturing and Energy Saving: Environmental protection and energy conservation have become important considerations in the manufacturing industry. In the future, SMT equipment will pay more attention to energy efficiency. By optimizing structural design, adopting efficient drive systems and energy-saving modes, equipment energy consumption will be reduced, carbon footprint will be reduced, and the green transformation of the electronics manufacturing industry will be promoted.

China's SMT manufacturing industry is rapidly rising. Printing, welding, testing, and other SMT equipment have largely achieved domestic production, and with competitive pricing, it holds a 70%-80% domestic market share.

In the future, with the large-scale application of technologies such as 5G, the Internet of Things, and artificial intelligence, the SMT industry will usher in a new round of development opportunities, leading to intensified technological innovation and market competition. When SMT equipment possesses self-evolving intelligence, interconnected collaboration, and proactive safety assurance, SMT production lines will truly enter a new era of "efficiency, stability, security, and intelligence."

Want to learn more about ETON’s SMT solutions?

Contact us for cooperation and product details:

Email: linda@eton-mounter.com

WhatsApp/WeChat: +86 136 7019 7725

ETON Automation — Smart Manufacturing, Global Vision